Financial

Pioneering financial services innovation and shaping the future of client-centric solutions

Financial Services and Solutions

Experience a new era of financial services innovation, where client-centric solutions and cutting-edge low-code technologies converge. Our transformative approach revolutionizes service delivery, empowers financial professionals and institutions, and delivers unparalleled value to clients.

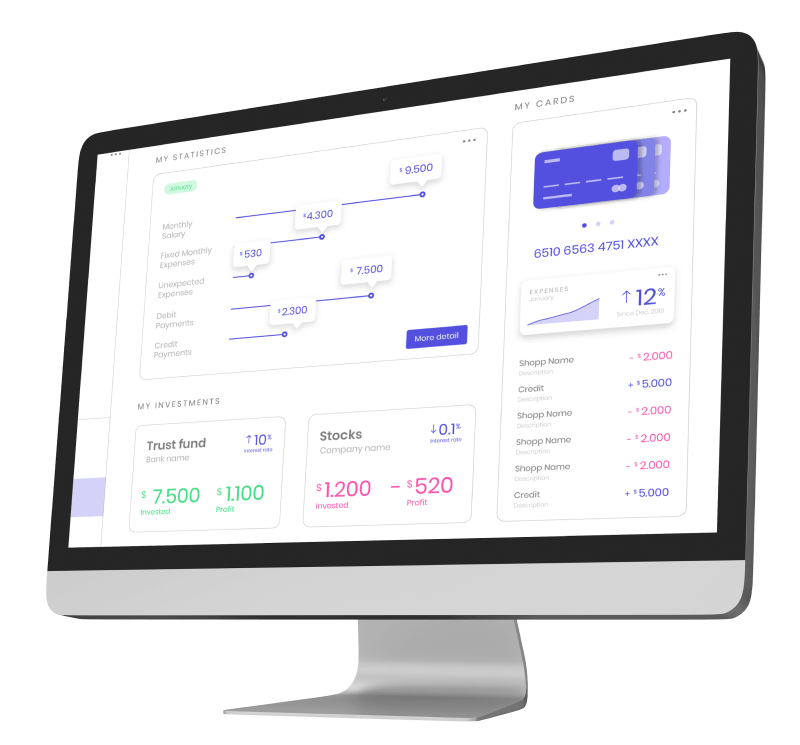

Mobile apps & Web Portals

Create applications with superior user experience, that enable your clients to manage their financial accounts, view transaction histories, transfer funds, pay bills and all type of financial activities.

Process Automation & Orchestration

Automate and Orchestrate financial operations, compliance controls, manage data models, integrate third-party services, and accommodate multiple devices and infrastructure connectors.

Financial Systems Modernization

Create and deploy a financial management system that streamlines your financial operations, enables data accessibility across all departments and authorized personnel.

Financial System Integration

Integrate financial information from different systems into a single unit, providing a unified view of your financial operations and improving your ability to serve clients.

Digital financial services delivery

Modernize the development and deployment of digital services, with fast builds from front-end UIs to APIs to back-end core systems.

Financial UX/UI development

Intuitive and engaging interfaces for your financial applications through our UX/UI design expertise.

Agile financial solutions

developed in low-code

Through low-code technology, we rapidly create advanced digital solutions for the financial sector, driving efficiency and enhancing customers outcomes. We work with several low-code technologies to suit the specific needs of our clients.

How financial institutions are benefiting from low-code

Accelerated Application Development

Enable rapid development and deployment of applications, allowing banks and financial institutions to quickly roll out new products, services, and digital experiences for their customers.

Cost Efficiency

Reduces reliance on extensive coding resources and shortens development cycles. This cost-effectiveness enables banks and financial institutions to optimize their IT budgets, accelerate time-to-market, and allocate resources strategically.

Scalability

Offers scalability, enabling banks and financial institutions to scale applications as their customer base and transaction volumes grow, handling of increased loads and supports future expansion plans.

Innovation and Experimentation

Rapid prototyping, testing, and iteration, empowering organizations to bring new financial products, services, and digital solutions to market faster.

Enhanced Customer Experience

Strong focus on user experience, enabling banks to create intuitive, user-friendly applications that enhance customer satisfaction, simplify interactions, and improve overall banking experiences.

Seamless Integration

Provide seamless integration capabilities with existing banking systems, such as core banking, payment processing, and customer relationship management (CRM) systems and ensures data consistency, improves operational efficiency, and delivers a cohesive user experience across various touchpoints.

Flexibility and Agility

Empower banks and financial institutions to adapt to changing market conditions, regulations, and customer expectations. Easily modify or build new applications to meet evolving business needs.

Regulatory Compliance

Provide compliance frameworks and controls tailored to the banking and financial services industry. This assists banks in adhering to stringent regulatory requirements, such as anti-money laundering (AML), Know Your Customer (KYC), and data privacy regulations.

Ensuring compliance financial standards

With profound comprehension of Anti-Money Laundering (AML), Know Your Customer (KYC), General Data Protection Regulation (GDPR), and Payment Card Industry Data Security Standard (PCI DSS) regulatory compliance, our cutting-edge digital solutions optimize financial services processes while ensuring client privacy and data security.

Trusted by leading companies and across multiple industries

We had the opportunity of serving diverse +30 clients across multiple industries, including telecommunications, healthcare, insurance, consumer goods, and many more. Our clients include some of the most reputable brands and are building long-term partnerships based on mutual trust and success.

Certified experts at

your service

Readiness IT is proud to have a team of +100 certified low-code experts who can help businesses build custom applications with speed, agility, and cost-effectiveness.

As a trusted partner in low-code platform development, we work with leading providers such as OutSystems, Appian, and Microsoft Apps to deliver solutions that meet the unique needs of our clients.

With Readiness IT, you can rest assured that you have a partner with the skills and experience to help you realize your digital transformation goals.

Get in touch, download a use case, and get a free guide about low-code

Take the first step towards accelerating your digital transformation today and request a free guide about low-code technologies, our projects, services, implemented use cases, and more. And if needed, our team of experts will be happy to answer any questions you may have and provide you with the information you need to make an informed decision.

Get in touch by filling out this form.